Last week I

submitted forms for withdrawal of PF from my last company. It had to go back in

loops two times in the absence of proper information on the process. So now

that I have gained information on the PF withdrawal process, I am putting it in

detail here for everyone of you who might need it.

Documents

required to submit to your last employer

- Form 19 (for EPF withdrawal)

- Form 10c (for EPS withdrawal)

- A blank cancelled cheque (this

is required to verify accuracy of MICR Code Number). The cheque should be

of you as a single account holder and not a joint account cheque.

Form 19 Page 1

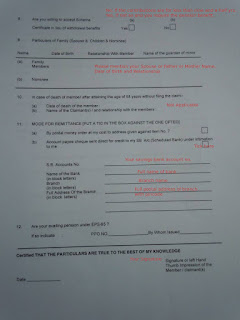

Form 19 Page 2

Instructions

on how to fill Form 10c :

Form 10c Page 1

Form 10c Page 2

On page 3,

you will have to affix a Revenue stamp and sign across it. Thats it. You need

not fill any other details.

Revenue

Stamp availability in Bangalore

Post offices do not keep revenue stamps. I was able to get it from Koramangala

BDA Complex for 5/- Rs. per 1 Re. stamp.

In Bangalore , affixing a revenue stamp is not

required so companies in Bangalore

Know your

claim status

Once your application is forwarded to the epf office by your employer, you can

check your claim status on epfo website. You will

also receive a sms from epfo stating that your application is received and is

under process.

With all

this information at your hand, I hope you would enjoy the process of submitting

PF forms :)

Update: My PF money is transferred to my

account electronically within a month of filing the claims.

Thanks. It was really good of you to post your experience. I too was looking out for revenue stamps but did not find it anywhere. Have not yet checked BDA complex tough. Will get one from there.

ReplyDeleteRevenue stamps not required

DeleteHello Arijit,

ReplyDeleteI have everything (documents) except revenue stamp and blank cancelled cheque ( delayedby bank).Pl do let know if there are alternatives to these two

I can give my bank's swift codes for e.g.

regards

Online transfer through organisation can be done

DeleteIf you at Bangalore its not required...else You check the post office of your location to get the stamp

DeleteThanks for the Info

ReplyDeleteHi

ReplyDeleteI am currently working in Bangalore, but my previous company was located in Hyderabad (Tech Mahindra). Do I need to attach the revenue stamps in this case ? And also tell me after all the documents are ready should i sent it to the previous employer ?

Hi Arijit,

ReplyDeleteWhere to get 1 rupee revenue stamp ?

I have to send all these documents to Maharashtra where IGATE people has asked me to send.

Hi Arijit,

ReplyDeleteWhere to get 1 rupee revenue stamp ?

I have to send all these documents to Maharashtra where IGATE people has asked me to send.

Hi

DeleteYou need to visit any post office at Maharashtra

You can opt for online ...its hassle free and easy

Hi there,

ReplyDeleteAs on date is it Ok to submit forms without 1re revenue stamp? I supose during the writing of blog 1 re revenue stamps were banned. Please advise at the earliest.

If you are Bangalore its not required.

DeleteFor other states we can visit any post office and check if revenue stamps are available

Further online process is hassle free

What if the company's head office and regional PF office is in Hyderabad and i need to send it there from Bangalore?

ReplyDeleteThere are 3 ways you can approach:

Delete1> Online transfer if any of the organisation has digital signature.

2>Fill the PF form , get the signature from organisation at Bangalore office

send it across to the organisation at Hyderabad office and request them to submit.

3>Fill the PF form,send it across to organisation at Hyderabad office for signature. Ask them to send it back to you.Submit the PF form to the organisation at Bangalore office and request them to submit.