My friend Arijit and Vineet had an query on Leave Travel Allowance. No better place than this , here it goes.

Basically, it is a monetary benefit that you get on the expenses you incur when you travel.

Here's to clearing your doubts.

1. On what basis can I claim LTA?

If you fulfill two criteria, you can do so:

i. You should have taken leave from your company

ii. You should actually travel

You can either travel alone or with your family. However, if your family travels without you, no LTA can be claimed.

2. How often can I claim LTA?

i. Twice in a block of four calendar years

ii. LTA is not related to when you started your employment as the government has fixed blocks of years for the purpose of claim.

iii. These blocks are not financial years (April 1 to March 31); they are calendar years (January 1 to December 31).

iv. The current block is 2010-13, that is, between January 2010 and December 2013.

v. During this time period, a person is entitled to two LTA claims.

vi. A person can get an income tax exemption for two journeys in a block of four calendar years. But he can make a trip only once in year.

3. What if I fail to avail of it?

In case you fail to do so, there is a carry over option.Let's say that in the block of four years, you never did claim any LTA. You can do so in the first year of the next block of four years.

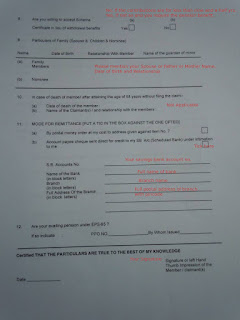

4. What is the proof of travel to avail of LTA?

According to rule 2B, you can produce an air, rail or any public transport ticket.You can even submit the bills issued by the car rental company if you rent a vehicle.However, the travel is applicable anywhere in India and not abroad. So an international air ticket will not hold.

5. Is LTA taxed?

You can receive LTA as either reimbursement or allowance.

Reimbursement:

In case of LTA as reimbursement, it is not taxable.

Let's say your company offers an LTA of Rs 50,000. For proof of travel, you produce an air ticket of Rs 10,000.In such a case, you can claim only Rs 10,000 as LTA and it will be exempt from tax.

Allowance:

If you do not submit any proof of travel, you will get your LTA but will have to pay tax on it.

If you produce proof of travel, it will not be taxable to the extent your proof of travel is covered.

Let's say you are entitled to Rs 50,000 as LTA as part of your salary. Since you produced proof of travel as Rs 10,000, you will not be taxed on this amount. However you will be taxed on the net Rs 40,000 as per your income tax slab rate.

LTA is not a fringe benefit as the latter are benefits that are usually enjoyed collectively by the employees and cannot be attributed to individual employees.

6. Can both spouses claim LTA?

If both spouses are getting the LTA benefit in their places of work, they can both claim exemption on LTA from their employers and the benefit for four journeys in one block.They do not have to take the precaution of not travelling twice during the same year.Moreover, they can take the same family members or different ones as long as they stick to the definition of the members for this purpose.

Family includes spouse, children as well as dependent parents, brothers and sisters. In respect of children born on or after October 1, 1998, the exemption will be restricted only to two surviving children unless the birth after one child has resulted in multiple births (twins or triplets).

7. If I and my wife travel this year, can we both claim LTA simultaneously?

No. You cannot claim LTA twice for the same journey. If both of you take a holiday together and you claim LTA, she cannot.

8. If I am entitled to a particular amount as LTA, but my expenses are higher, can I claim more?

Say in the year 2005-06, you receive on Rs 8,000 as LTA, but spend Rs 50,000 on travel. You can claim exemption only to the tune of Rs 8,000.